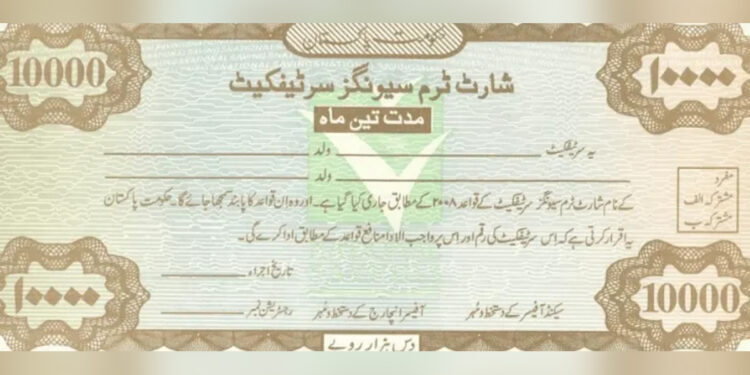

July 2012, the Qaumi Bachat Bank, also known as the National Savings Centre, unveiled the Short Term Savings Certificates (STSCs) program, catering to the short-term funding needs of investors. The profit rates for these savings certificates underwent revision in January 2024.

Flexible Maturity Options: Tailoring Investments to Your Needs

The maturity period for STSCs spans three months, six months, and one year, providing investors with flexible options to align with their financial goals. These certificates are pledge-able and offer schemes with varying maturity durations of 3-month, 6-month, and 1-year.

Inclusive Accessibility: Who Can Invest in STSCs?

STSCs are accessible to all Pakistani nationals and Overseas Pakistanis, offering options for single adults, minors, or joint investments by two adults. Payments can be received jointly (Joint-A) or by any one of the holders (Joint-B).

Investors have the flexibility to deposit a minimum of Rs10,000 in this category, with no maximum limit imposed.

Short Term Savings Certificates Profit Rate 2024: A Lucrative Investment Opportunity

The profit rates for STSCs in 2024 present an attractive investment proposition:

- Three-Month Maturity: A substantial 20.28 percent profit rate, equivalent to Rs5,070 per Rs100,000.

- Six-Month Maturity: Investors can benefit from a profit rate of 20.3 percent, translating to Rs10,150 per Rs100,000.

- One-Year Maturity: For those opting for a more extended investment horizon, a profit rate of 20.34 percent or Rs20,340 per Rs100,000 is offered.

Tax Implications: Filers vs. Non-Filers

Understanding the tax implications is crucial for investors:

- Filers (Active Tax Payer List – ATL): Withholding tax is set at 15% of the yield/profit, regardless of the investment date or amount/profit.

- Non-Filers (Not in ATL): Non-filers are subjected to a higher withholding tax rate of 30% of the yield/profit, irrespective of the investment date or amount/profit.

Zakat Exemption: Supporting Financial Inclusion

Investments made in STSCs enjoy exemption from Zakat collection, providing an additional incentive for those looking to align their investments with both financial growth and philanthropy.

As the Qaumi Bachat Bank continues to evolve its financial offerings, the STSCs program stands out as a versatile and accessible avenue for investors seeking short-term financial solutions with competitive profit rates.