ISLAMABAD – In response to the declining inflation rate, the Qaumi Bachat has reduced the profit rates on Defence Savings Certificates (DSCs) starting from December 2024.

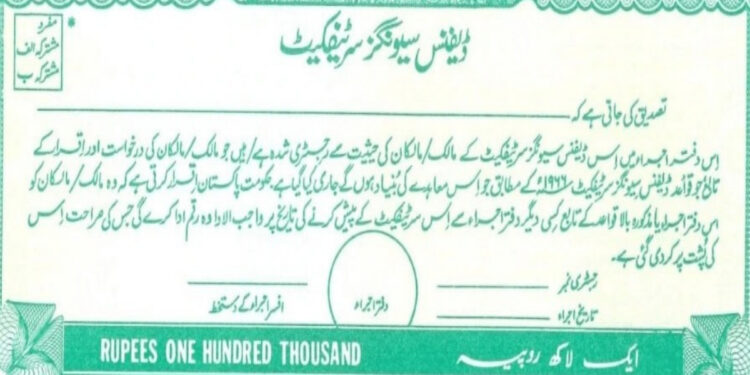

Introduced decades ago, Defence Savings Certificates were designed to help long-term investors meet their financial goals. The National Savings offers a maturity plan of up to 10 years, allowing investors to maximize their benefits and profits on savings.

Effective from December 10, 2024, the National Savings, also known as Qaumi Bachat Bank, has revised the profit rate for Defence Savings Certificates.

Both Pakistani nationals and overseas Pakistanis are eligible to invest in these certificates, which are available in denominations of Rs. 500, Rs. 1,000, Rs. 5,000, Rs. 10,000, Rs. 50,000, Rs. 100,000, Rs. 500,000, and Rs. 1,000,000, with a 10-year maturity period.

Defence Savings Certificates Profit January 2025

The profit rate for Defence Savings Certificates is set at 12.19%. Below are the annual profits for an investment of Rs. 100,000, based on a 10-year maturity period:

First Year Rs109,000

Second Year Rs119,000

Third Year Rs130,000

Fourth Year Rs143,000

Fifth Year Rs159,000

Sixth Year Rs179,000

Seventh Year Rs204,000

Eighth Year Rs235,000

Ninth Year Rs272,000

Tenth Year Rs316,000

Tax and Zakat Deductions

As per the State Bank of Pakistan’s policy, taxes and Zakat are deducted from the profits. The withholding tax rate for filers is 15%, while for non-filers, it is set at 30%.