Islamabad, November 2024 – The Central Directorate of National Savings (CDNS) has announced a reduction in the profit rates for its Short Term Savings Certificates (STSCs) starting from November 4, 2024. The decision comes in response to the recent decline in inflation and favorable economic indicators.

What are Short Term Savings Certificates (STSCs)?

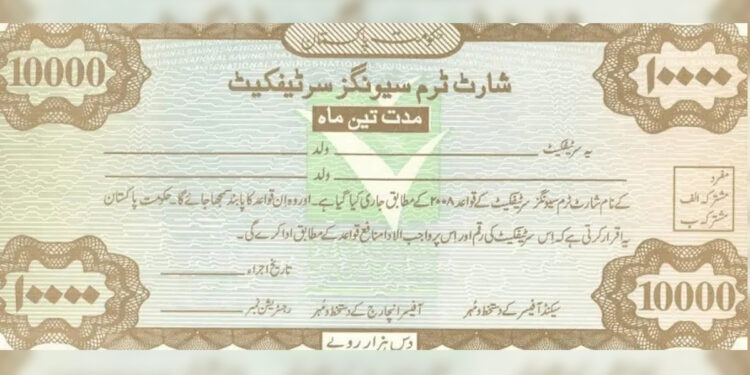

Introduced in 2012, the Short Term Savings Certificates (STSCs) are designed to meet the short-term investment needs of individuals. The program offers flexible maturity options: 3 months, 6 months, and 1 year. These certificates can be pledged as collateral and are available to both Pakistani nationals and overseas Pakistanis.

The minimum investment required for STSCs is Rs10,000, with no upper limit, making it accessible to a wide range of investors.

Revised Profit Rates for Short Term Savings Certificates

The CDNS has lowered the profit rates for the three maturity categories of the STSC program. The updated profit rates are as follows:

- 3-Month STSC: The profit rate has been reduced to 14.32%, which translates to Rs3,580 on an investment of Rs100,000, down from the previous rate of 18.52% (Rs4,630).

- 6-Month STSC: The profit rate for this category is now 13.46%, offering a return of Rs6,730 on an investment of Rs100,000, down from 18.22% (Rs9,110).

- 1-Year STSC: For the one-year maturity, the new profit rate is 12.96%, or Rs12,960 on Rs100,000, a decrease from the previous rate of 17.22% (Rs17,220).

Tax Deductions on STSC Earnings

The government has also set the tax deduction rates for the earnings on these savings certificates, which differ for filers and non-filers:

- Filers: Individuals listed in the Active Taxpayer List (ATL) will have a withholding tax rate of 15% on the profit earned from STSCs, regardless of the investment amount.

- Non-Filers: For those not listed in the ATL, the withholding tax rate will be 30% on the earned profit, irrespective of the amount or date of investment.

Conclusion

The reduction in profit rates reflects the ongoing adjustments in Pakistan’s financial landscape, driven by lower inflation and stronger economic indicators. While the profit rates have decreased, STSCs remain a popular choice for short-term investors looking for secure, government-backed savings options.

Note: Always consider consulting a financial advisor before making investment decisions to ensure the best choice based on your individual needs and tax situation.