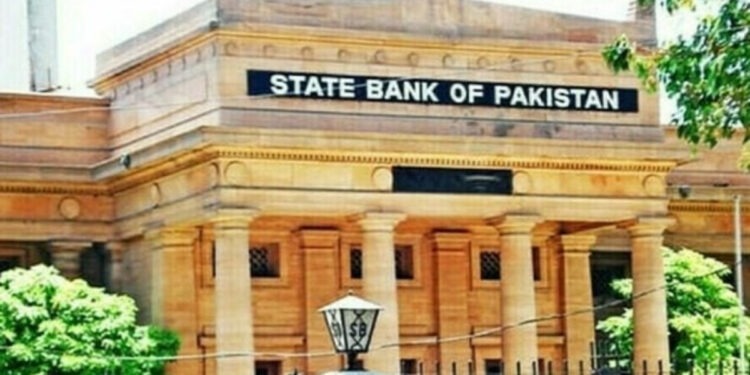

On Monday, the State Bank of Pakistan (SBP) announced a notable interest rate reduction of 2.5 percent, lowering the rate from 17.5 percent to 15 percent.

This marks the fourth consecutive decrease, amounting to a total reduction of seven percent during this period. The decision was made during a meeting of the Monetary Policy Committee (MPC), chaired by the SBP governor, who evaluated the current micro and macroeconomic conditions.

The SBP indicated that both domestic and international economic indicators were considered in the decision-making process.

According to the central bank, these measures aim to stabilize the Pakistani rupee, control inflation, and bolster foreign exchange reserves.

Recent data reveals that inflation has fallen to its lowest level in four years, reaching 7.2 percent in October. This has led economists to believe that the SBP is in a strong position to implement a significant interest rate cut.

Trade organizations had previously requested a reduction in the interest rate by three to five percent.

Experts noted that with the rupee stabilizing and foreign exchange reserves reaching a 30-month high, the current environment is favorable for further easing of monetary policy.